Stocks

What you need to know about the Pegasus SPAC IPO

By Beansprout • 19 Jan 2022 • 0 min read

The lesser known SPAC has an established European asset manager and France’s richest man behind it. How does it stack up against Vertex?

In this article

TL;DR

- Pegasus Asia is set to be the second SPAC to list in Singapore, with a market cap of S$150 million post-offering.

- Its key sponsors are European asset manager Tikehau and the family office of LVMH CEO Bernard Arnault, and it is looking to acquire a tech-enabled, disruptive, new economy business with operations primarily in Asia Pacific.

- Highlights of the SPAC include a respectable board of directors, LVMH’s global brandname and some alignment of interests between sponsors and investors.

- However, investors may be deterred by lack of progress in the sponsors’ previous SPACs in making acquisitions, no cornerstone investors in the offering, and limited clarity on the sponsors’ domain knowledge in the Asian tech sector.

Recap: What are SPACs?

What happened?

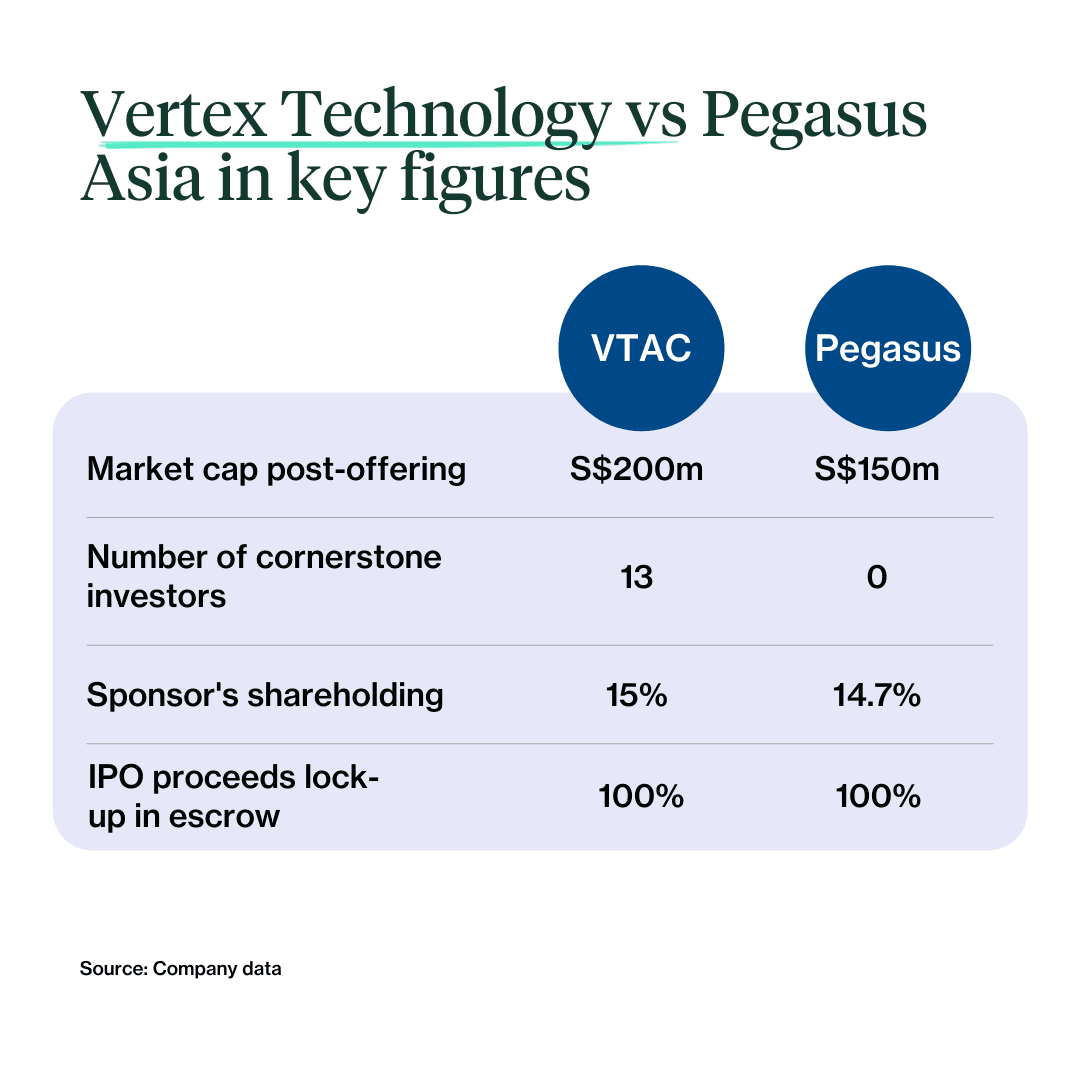

Coming at the heels of Vertex Technology Acquisition Company (VTAC)’s listing, Pegasus Asia is set to be the second Special Purpose Acquisition Company (SPAC) to be listed in Singapore. Compared to Vertex, Pegasus is less of a well-known name amongst the public in Singapore. Hence, we try to dig deeper to take a look at whether this SPAC listing is as promising as VTAC.

Pegasus Asia is raising gross proceeds of S$128mn by issuing 25.6 million SPAC units at S$5.00 per unit. Of these, 600,000 units will be available to the public. Including the sponsors’ commitment to 4.4 million units, the SPAC’s total market capitalization on the completion of the offering is expected to be S$150 million. The public offer will close at noon on 19 January, and the units are expected to start trading at 9am on 21 January.

What you need to know

Using Beansprout’s framework of analysing SPACs, we take a deeper look at (1) Pegasus’s sponsor team and experience, (2) Pegasus’ sector focus, (3) investor protection and alignment of interests to determine if the IPO might be worth considering.

(1) Pegasus’ sponsor team

As a blank check company with no operating history and assets, the quality of the sponsors could determine the prospects of the SPAC. This is quite similar to the importance of REIT managers in determining whether the REIT is well-run and is able to find quality acquisitions.

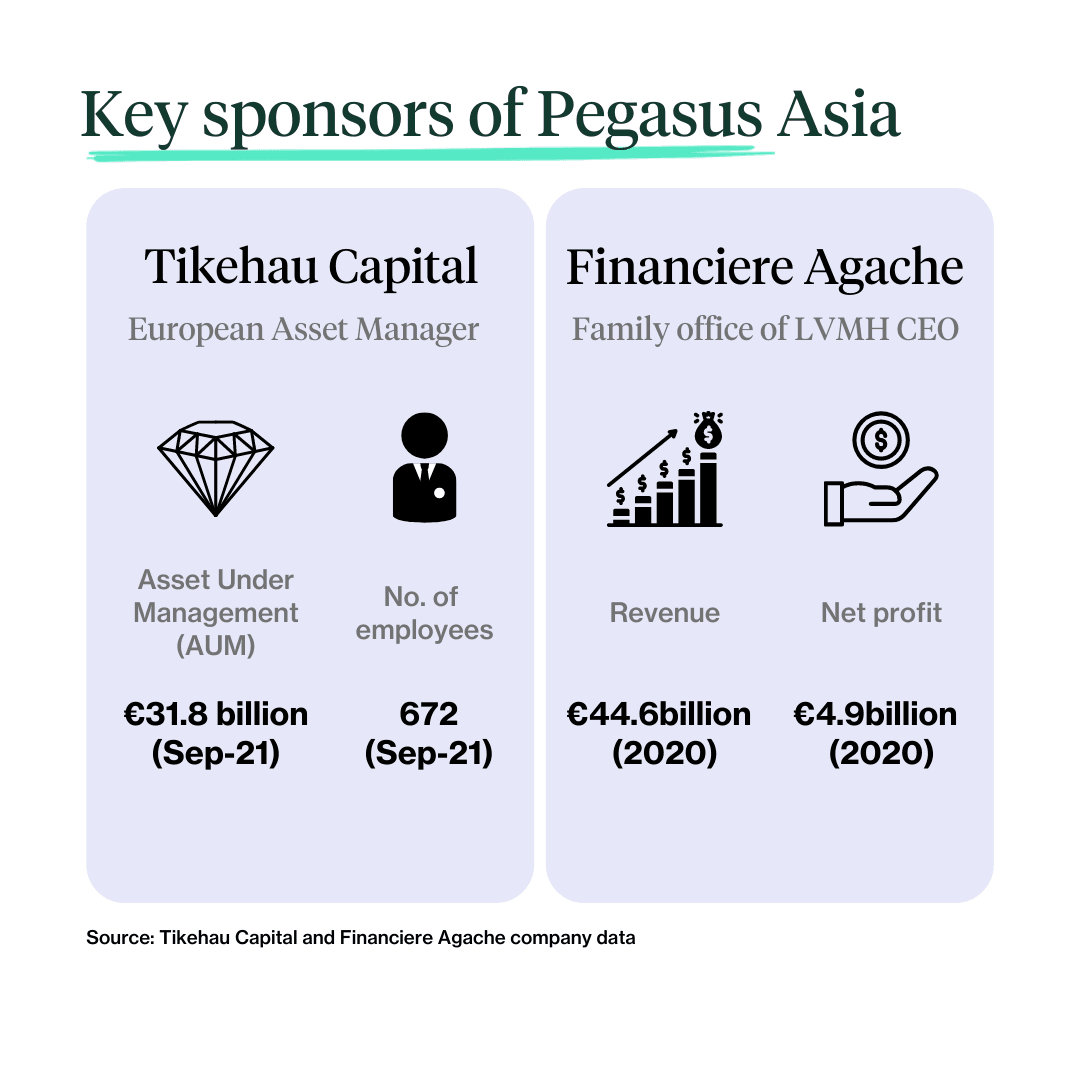

Pegasus’ sponsors are European alternative asset manager Tikehau Capital and Financiere Agache, which is the family office of France’s richest man, LVMH CEO Bernard Arnault. The sponsor group also includes two former senior bankers – Diego De Giorgi and Jean Pierre Mustier, who have worked together on capital markets transactions for more than a decade.

Many in this part of the world might not be familiar with Tikehau Capital and Financiere Agache. Tikehau has assets under management of €31.8 billion as at September-2021 across four asset classes of private debt, real assets, private equity and capital market strategies. It is listed on the Euronext Paris market under the ticker TKO FP with a market capitalization of €4.2 billion as of 18 January 2022. Financiere Agache is a controlling shareholder in luxury brands Christian Dior and LVMH. Tikehau has partnered with Financiere Agache for two other SPAC listings in Europe, but both of them have yet to make acquisitions.

Pegasus has put together a respectable board of directors. The Chairman of Pegasus Asia is Ms Eleanor Seet, who is the President and Head of Asia ex-Japan of Nikko Asset Management Asia, a leading fund manager in the region. Other prominent board members include the CEO of EDB Investments, Ms Chu Swee Yeok and the Chairperson of Singapore Institute of Directors, Ms Wong Su-Yen. The SPAC’s CEO is Neil Parekh, who is the Head of Asia, Australia, and New Zealand of Tikehau Capital.

(2) Pegasus is looking to leverage on its global footprint and visibility

Pegasus’ mandate is to complete a business combination within 24 months from the listing date with technology-enabled, disruptive, new economy business that have operations primarily centred in Asia Pacific. This would include consumer tech, fintech, proptech, insurtech, healthtech and digital services. The targets will have the following characteristics:

- Disruptive and new-economy aligned. They challenge existing market norms and incumbents in large addressable markets.

- Technology-enabled. These businesses strive to be agile, digitalized, data-driven and highly scalable.

Elaborating on this, the CEO of Pegasus Neil Parekh said in an interview with the Business Times that “We’re looking for a company whose reason to exist is no longer under question. However, it is looking to use technology to disrupt its own business as well as the sector.”

It would also seem like the sponsors are looking to leverage on the LVMH brandname, as Parekh also mentioned that “many companies want to be part of the Tikehau/LVMH ecosystem to go international. People go public not only for the money that comes with an IPO. They go public for visibility, they go public for having a currency to make acquisitions.”

In terms of the timing of the business combination, Parekh added that “We hope to execute very soon after the IPO. Our intention is to de-SPAC (as soon as possible).

(3) Alignment of interest between sponsor and investors

(3) Alignment of interest between sponsor and investors

One of the key characteristics of SPACs are the safeguards that are provided to investors. Under SGX listing rules, SPACs are required to deposit at least 90% of their proceeds in a third party account (escrow) to safeguard the money invested until the acquisition is completed. Like VTAC, Pegasus has gone above the requirement by its commitment to deposit 100% of the IPO proceeds into the escrow account.

SGX SPAC sponsors are also required to have a minimum equity participation to ensure they have sufficient “skin in the game”. In this regard, Pegasus’ sponsors are subscribing to 4.4 million units for S$22 million, making up 15% of Pegasus’s S$150 million market capitalization post-offering. Again, this exceeds the requirement for sponsors to have at least a 3.5% stake.

One interesting feature to highlight is that Pegasus has made an unconditional and irrevocable commitment to further invest S$40 million in units at the point of the business combination, via a forward purchase agreement, with Tikehau Capital and Financiere Agache contributing S$20 million each. This reflects the confidence of the sponsors on the long term prospects of the target to a certain extent. On this note, CEO Parekh also mentioned that “Assuming the de-SPAC is with a candidate … of say approximately S$1 billion market cap, the intention is to grow that into a S$7-8 billion company over time.”

What would Beansprout do?

While Pegasus has not received as much attention as VTAC, it has definitely some highlights:

- It has put together a respectable board of directors

- Pegasus can tap on LVMH’s global brand name to attract potential targets

- The SPAC is structured with certain alignment of interests between sponsors and shareholders

However, some of the issues that may deter investors include:

- Looking at its track record, the sponsors’ first SPAC Pegasus Europe was listed in April 2021, but has yet to make an acquisition as of today.

- There are no cornerstone investors for the offering, which may reflect lower degree of institutional investor confidence in the SPAC.

- Given the sponsors’ background in Europe and focus on the consumer space, it is less clear whether they have the domain knowledge and network to find a quality target in the tech space in Asia Pacific.

Separately, investors should also make sure they are aware of the product structure and risks associated with investing in SPACs, and think about how having SPACs in their portfolios would align with their investment objectives and risk appetite.

Read also

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

0 comments