Stocks

Weekly Review with SIAS: Positive trends in global stock markets

Powered by

By Beansprout • 06 May 2024 • 0 min read

We share more about DBS and Mapletree Logistics Trust in the latest Weekly Market Review.

In this article

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss the growing upward trend in the global equity market and also share more about the following:

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

1:45 - Macro update

- The global equity market was positive last week, with the S&P 500 up 0.5% and the Nasdaq gaining 1.4%, driven by tech stocks.

- The Fed meeting left interest rates unchanged, and Fed Chairman Jerome Powell's comments suggested that the next action may not be a rate hike, leading investors to hope for rate cuts later this year.

- US non-farm payroll data was weaker than expected, reinforcing expectations of rate cuts.

4:45 - Singapore market updates

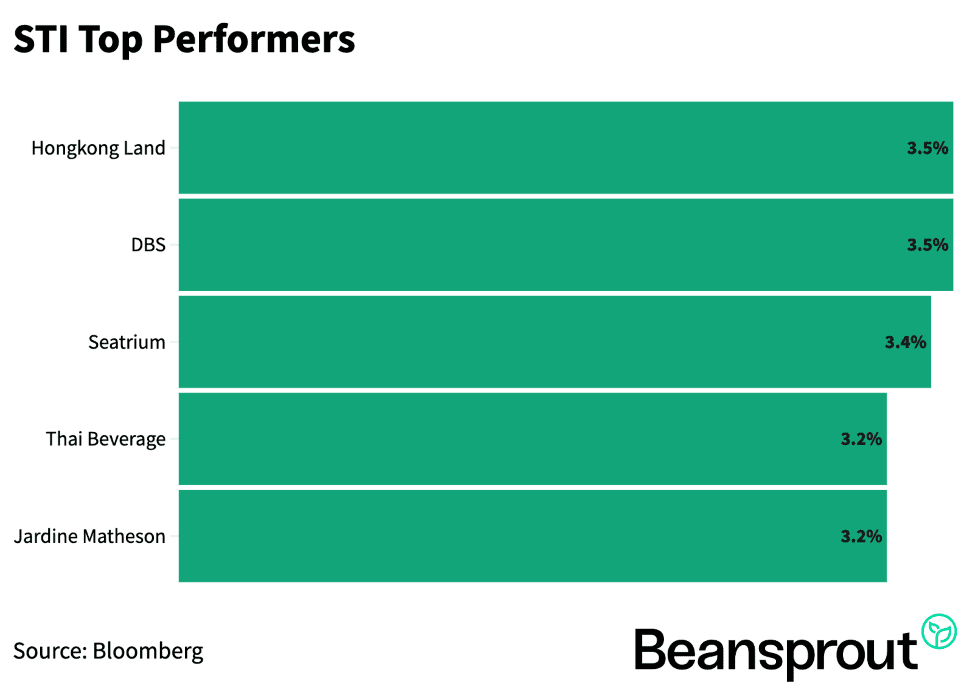

STI top performers:

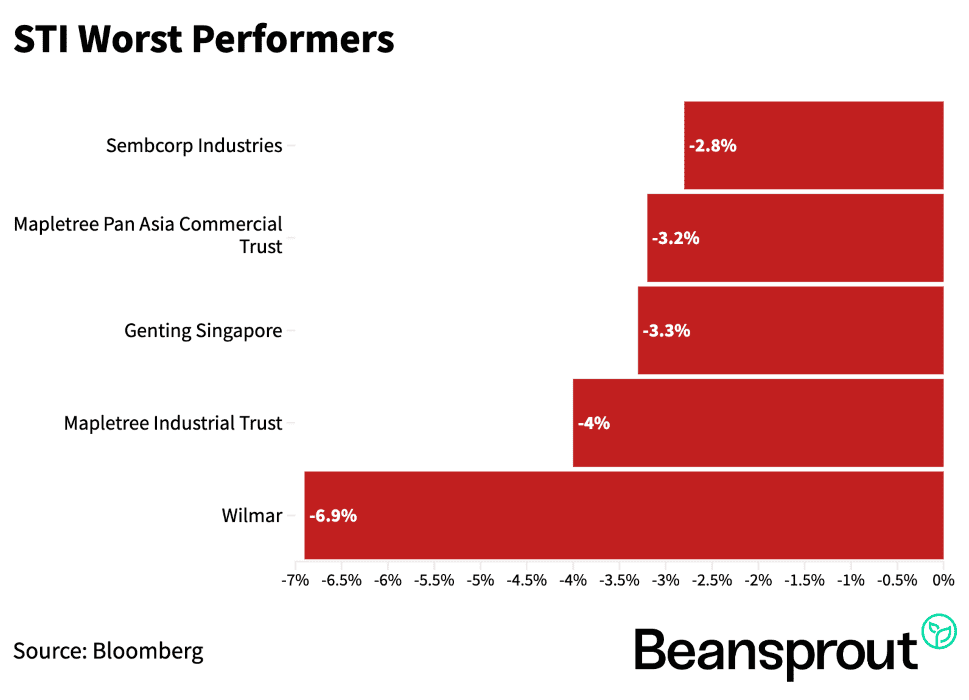

STI worst performers:

- Sembcorp Industries

- Mapletree Pan Asia Commercial Trust

- Genting Singapore

- Mapletree Industrial Trust

- Wilmar

DBS

- DBS reached a record high share price and became the first Singapore-listed stock to exceed a $100 billion market capitalisation.

- The share price reached $35.50, with a strong gain year-to-date.

- DBS also reported record-high total income and net profit, with a 15% increase in net profit to $3 billion in the first quarter.

Outlook

- Geopolitical risks persist, but macroeconomic conditions remain resilient

- Group net interest income to be modestly better than 2023 levels

- Cost-income ratio to be in low-40% range

- Net profit to be above 2023 levels

Read our analysis of DBS here.

Mapletree Logistics Trust

- Mapletree Logistics Trust's share price has been weak this year, falling from $1.70 to $1.35 per share.

- The trust reported slightly increased gross revenue and net property income, but borrowing costs rose 7%, leading to a 1.1% increase in distributable amount to unit holders.

- Portfolio occupancy remained steady at 96%, with Singapore assets showing resilience at 96.6% occupancy.

- Gearing levels increased slightly to 38.9% but remained below 40%.

- The weighted average interest rate was kept stable at 2.7%, indicating manageable debt costs despite rising interest rates.

- Mapletree Logistics Trust share price and dividend history

13:41 - Technical Analysis

Straits Times Index

- The STI index has seen a 4% gain over the past two weeks, with a high of 3,324 points on May 2nd.

- The upside momentum is slowing down, with the MACD indicator showing a slowdown in momentum over the past three trading sessions.

- The RSI indicator is at 65, indicating a strong momentum reading, but close to the overbought mark of 70.

- Support levels are at 3,000 and 3,200, while resistance levels are at 3,250 and 3,300.

Dow Jones Index

- The Dow Jones index bounced up 1.18% on Friday, closing at 38,675 points. The index has broken above the 20-day moving average and is on track to retest the upper bound of the Bollinger Band at around 39,000 points.

- The target is 40,000 points by the end of the year.

- The MACD indicator is in positive territory, and the RSI indicator is at 54, indicating positive momentum.

S&P 500 Index

- The S&P 500 index also bounced above the 20-day moving average and is on track to retest the upper bound of the Bollinger Band at around 5,200 points.

- The MACD indicator has turned positive, and the RSI indicator is at 53, indicating positive momentum.

Nasdaq Composite Index

- The Nasdaq Composite Index was the best performer last week, driven by positive sentiment towards rate-sensitive tech stocks.

- The index has two positive readings on the MACD indicator and the RSI indicator is at 55, indicating strong momentum.

- The target for the Nasdaq Composite Index is 16,464 points, with a year-to-date high of 16,538 points.

What to look out for this week

- Monday, 6 May: Lendlease REIT earnings

- Tuesday, 7 May: Frasers Logistics & Commercial Trust earnings

- Wednesday, 8 May: UOB earnings

- Thursday, 9 May: SIngapore 6-month T-bill auction

- Friday, 10 May: OCBC earnings

Get the full list of Singapore stocks, REITs and ETFs with upcoming dividend payments with our dividend calendar.

Sign up for our free newsletter to get market insights delivered to your mailbox every Sunday!

Read also

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

0 comments