Stocks

What are Structured Certificates and how do they provide potential yield enhancement?

Powered by

By Gerald Wong, CFA • 07 May 2024 • 0 min read

Structured certificates offer a combination of features that can include income generation and participation in market gains.

In this article

This article was created in partnership with SGX. The views and opinions expressed are Beansprout's objective and professional opinions.

What happened?

With global stocks being volatile in recent weeks, we received questions on whether there are financial instruments for us to manage our portfolios in different market scenarios.

In particular, some investors were keen to find out if there are products that allow us to invest in stocks at a lower target entry price, while earning a potential distribution in the meantime.

We were hence curious to find out more about Autocallable Certificates, a type of Structured Certificates payoff which was launched on the Singapore Exchange in August last year.

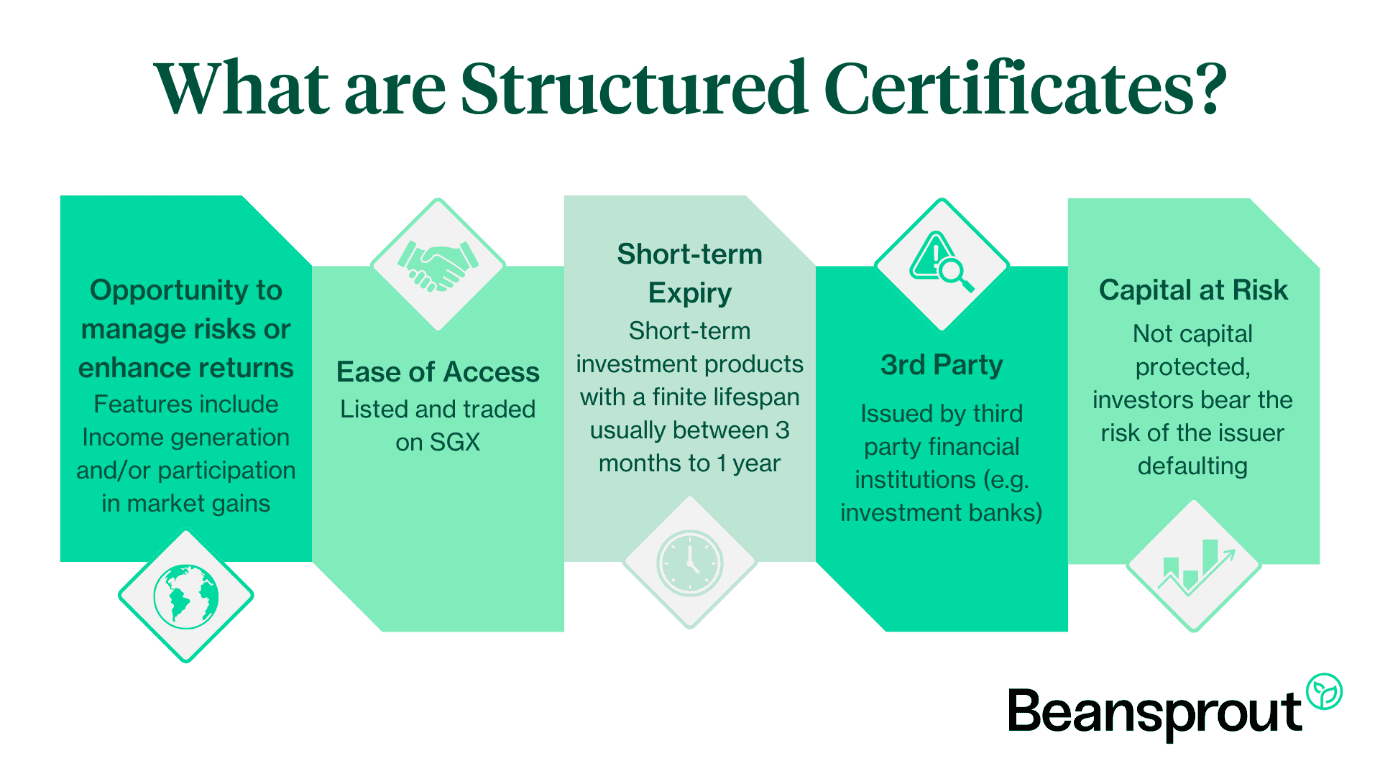

According to the SGX, Structured Certificates provide new ways for investors to trade beyond the existing suite of direct stocks, ETFs and leverage products, providing them opportunities to manage risks or enhance yields in a rangebound market.

SGX is the first Asian exchange to offer trading in Structured Certificates, even though these payoffs are not uncommon in the listed space in Europe.

Let us find out more about Structured Certificates and how they can be used to meet the needs of investors for yield enhancements or growth payoffs.

What are Structured Certificates?

Structured Certificates are structured products based on an underlying asset, such as a single stock or equity index, and contain derivative components.

They offer a combination of features that can include potential income generation and participation in market gains.

In Singapore, Structured Certificates are listed and traded on SGX, providing investors with ease of access.

They are issued by third-party financial institutions, usually investment banks.

How do Structured Certificates work?

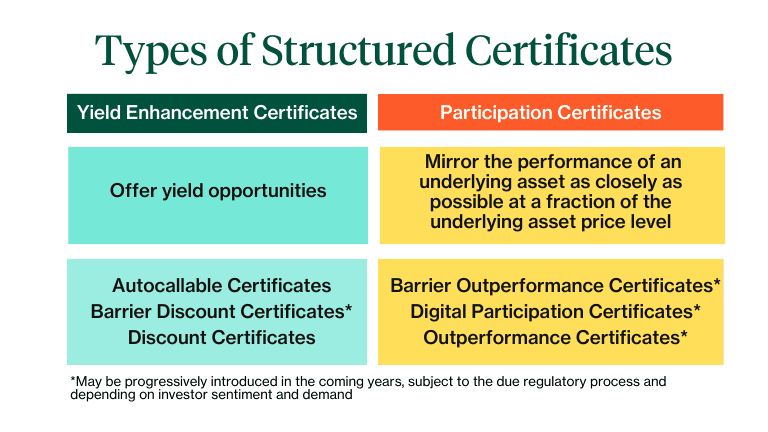

There are different kinds of Structured Certificates, broadly categorised into Yield Enhancement and Participation payoffs.

Certificates in the Yield Enhancement category offer investors the potential to earn a yield on their investments, particularly in a rangebound market. Some examples of Yield Enhancement certificates include Discount Certificates and Autocallable Certificates.

As an introduction to Structured Certificates, we will go through an example of an Autocallable Certificate to explain how it works.

Autocallable Certificates are meant for investors who have taken the view that the price of the underlying security is likely to remain flat or rise only slightly over the period of investment.

They are also meant for investors who would like to receive a potential yield on their investments.

Let us look at an illustrative example of an Autocallable Certificate with Alibaba as the underlying stock.

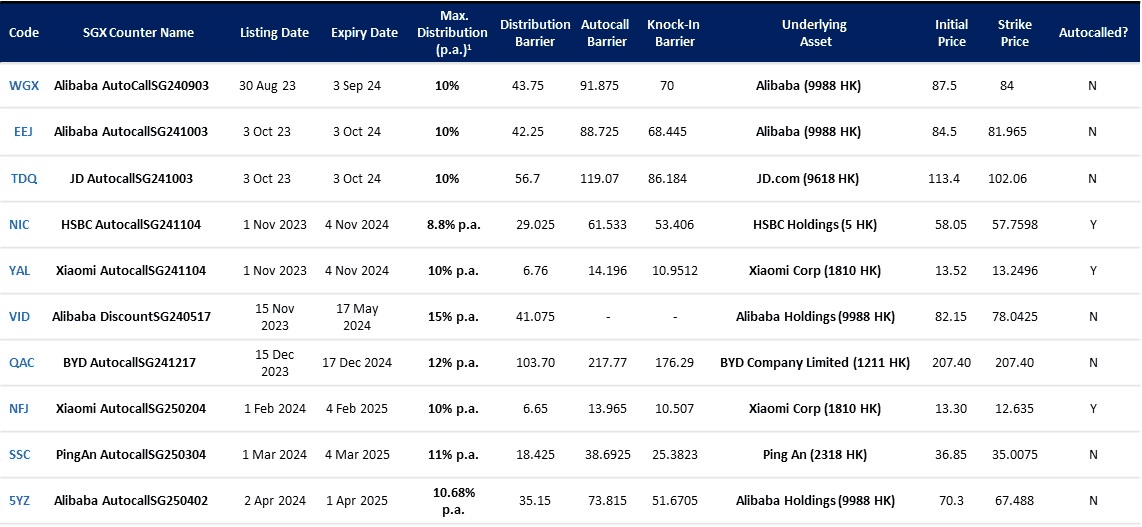

In this case, I may be keen to invest S$10,000 in Alibaba at the target entry price of around HK$ 67, compared to the current stock price of HK$ 70.3.

I can choose to wait for the price to fall to my target entry price of HK$ 67. Alternatively, I can consider buying into an Autocallable Certificate listed on SGX (Stock Code: 5YZ) that pays 10.68% p.a. conditional distribution.

When I purchase the Autocallable Certificate, my view on Alibaba is relatively neutral with a view that that Alibaba’s stock price will not rise beyond HK$ 73.815 or fall more than 26.5% to below HK$ 51.6705.

The Autocallable Certificate provides me with an opportunity to earn an enhanced yield during the tenor of the certificate, while waiting to purchase Alibaba shares at my target level below the current market price.

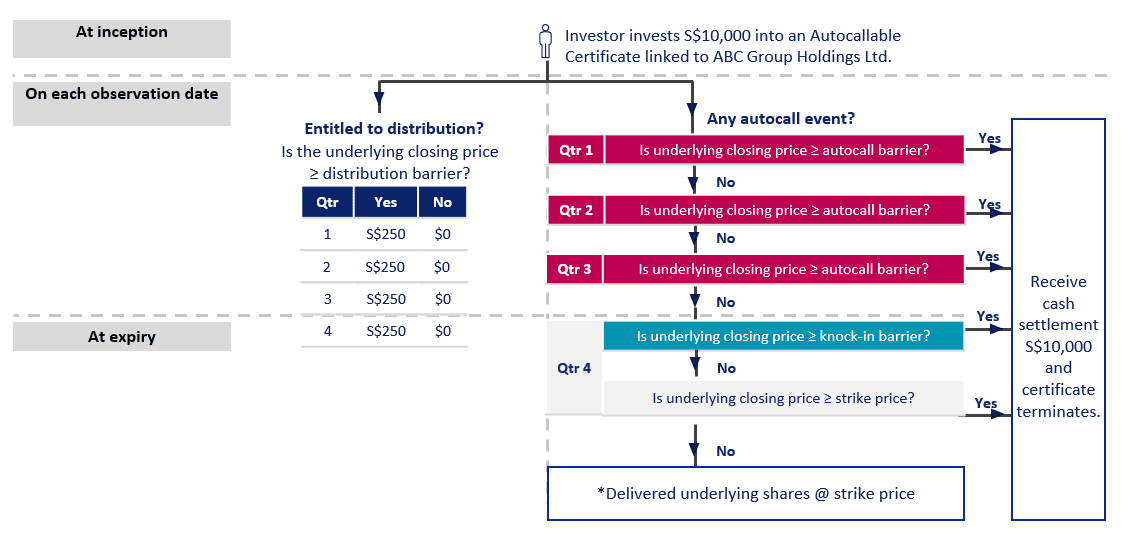

In this example, assume I invested S$10,000 into the Autocallable Certificates.

With an expiry date of 1 year, my investment will be locked up for the full tenor. Hence, I would need to make sure I do not have any liquidity needs during this period of time.

With a distribution amount of 10.68% per annum (p.a.), I can receive this distribution on the observation dates if the underlying price of the Alibaba is higher than or equal to the Distribution Barrier.

In this case, I will receive the distribution of 2.67% p.a. (e.g. S$267) on each quarter if the underlying price of Alibaba is at least HK$ 35.15 on the quarterly observation dates e.g. 2 July 2024, 2 October 2024, 2 January 2025 and 1 April 2025.

However, there may be early redemption of the principal if the share price of the underlying rises significantly.

The Autocallable Certificate will be early redeemed on the first observation date that Alibaba closes higher than or equal to the Autocall Barrier of HK$ 73.815.

The certificate will terminate and you will receive your investment amount back, along with the distribution amount for that quarter.

As investors who buy into Autocallable Certificates should have a neutral view on Alibaba, this feature allows me to reinvest my money if my initial view of the underlying is incorrect and it proves to be more bullish than expected.

If Alibaba closes below the Knock-in Barrier on the Knock-in observation date, then I will either redeem the principal or take delivery of the underlying shares.

How is this decided?

If the share price of Alibaba is equal to or above the Knock-in Barrier of HK$ 51.6705 on 1 April 2025, then I will receive back my principal.

However, if the share price of Alibaba is below HK$ 51.6705 on 1 April 2025, then I will receive Alibaba shares at the strike price of HK$ 67.488.

The number of shares received will be equivalent to having your initial investment of S$10,000 invested into Alibaba shares at entry level of HK$ 67.488.

In summary, here’s a quick recap of how the Autocallable Certificate works, assuming conditional distribution is 10% (p.a.).

What are the benefits of Structured Certificates?

#1 – Potential for enhanced yield

As can be seen in the example above, an Autocallable Certificate may have the potential to generate higher returns compared to traditional fixed income instruments, such as T-bills and Singapore Savings Bonds.

In the illustrative example above of an Autocallable Certificate with Alibaba as the underlying stock, an investor can earn a potential yield of 10.68% per annum, if the share price of Alibaba stays between HK$35.15 and HK$73.815 on all four observation dates, and remains above HK$51.6705 on the knock-in observation date of 1 April 2025.

This means that there is potential to enhance our yield on our investment even in a range-bound market.

#2 – Ease of access

Such yield enhancement and participation structured products used to be available only to accredited investors who can access the product through priority banking or private banking accounts.

With the Structured Certificates listed and traded on the Singapore Exchange with a continuous quotation by a Designated Market Maker, qualified investors are now also able to access the product with greater price transparency and liquidity.

What are the risks of Structured Certificates?

Structured Certificates have a complex payout structure and are not capital guaranteed.

Hence, you need to make sure you understand the product well and are aware of the risks before investing.

Some of the risks of investing in Structured Certificates include issuer risk and potential for capital loss, amongst others.

#1 - Issuer risk

Structured Certificates are issued by third-party financial institutions, usually investment banks.

When you purchase a Structured Certificate, you are taking on a credit risk relating to the issuer.

Hence, you must be comfortable taking on this counterparty risk.

In the event that the third-party financial institution faces financial challenges, your investment in the Structured Certificate may be impacted.

#2 – Potential for capital loss

As shared in the illustrative example, the value of your investment in the Structured Certificate may fluctuate due to different reasons.

This may include the price and volatility of the underlying stock, the time remaining to expiry, interest rates, as well as the creditworthiness of the issuer, amongst others.

For example, if the price of the underlying asset were to fall sharply, you may face a significant loss on your investment in the Structured Certificate.

Also, the trading of the Structured Certificate in the secondary market may be limited as there may not be many buyers and sellers.

As such, you may not be able to get your desired price should you wish to sell the Structured Certificate before the expiry date.

Who may consider Structured Certificates?

You will need to be qualified to invest in Specified Investment Products (“SIP”) to be able to buy structured certificates.

To qualify, you will need to complete a customer account review with your broker.

Your broker will assess if you have the relevant knowledge and experience to invest in SIPs, using criteria consisting of educational qualifications, work experience and investment experience. You will need to satisfy at least 1 of the 3 criteria above to qualify.

Investors who are keen to invest in SIPs but do not have the relevant knowledge and experience can access the SIP Online Learning module here.

What are the Structured Certificates listed in Singapore?

The inaugural Structured Certificates was launched on the SGX with an Autocallable Certificate linked to Alibaba Group Holding (9988.HK).

More Structured Certificates have been issued since then, on both Autocallable Certificate and Discount Certificate payoffs. There are now ten Structured Certificates listed in Singapore, with typically one new issuance every month.

Societe Generale is the issuer of the Structured Certificates currently listed in Singapore. You can visit the issuer website to view product offerings and termsheets.

What would Beansprout do?

Structured Certificates have a combination of features that may offer investors potential yield enhancement and participation in market gains.

Structured Certificates are also now more accessible as they are listed and traded on the Singapore Exchange, and can be bought and sold through a stockbroker in a regular brokerage account.

Investors who wish to participate in the primary launch can reach out to the Sub-Placing Agents (also Physical Delivery Agents) listed on issuer’s website.

However, with a complex payout structure, we will need to make sure that we understand the product features before we invest in them.

You will also need to be qualified to transact in Specified Investment Products (SIPs) to buy Structured Certificates.

If you are keen to find out more about Structured Certificates, learn more at the SGX product page here.

Disclaimer

Any information provided in this article is meant purely for informational and investor education purposes and should not be relied upon as financial or investment advice, or advice on corporate finance.

This article is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to purchase any financial product or subscribe or enter any transaction. This article also does not take into account your personal circumstances, e.g. investment objectives, financial situation or particular needs and shall not constitute financial advice. You should consult your own independent financial, accounting, tax, legal or other competent professional advisors.

The information provided in this article are on an “as is” and “as available” basis without warranty of any kind, whether express or implied. Beansprout does not recommend any particular course of action in relation to any investment product or class of investment products. No information is presented with the intention to induce any person to buy, sell, or hold a particular investment product or class of investment products.

Find out how structured certificates provide investors with opportunities to manage risks or enhance yields with ease.

Read also

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

1 comments

- Johnny • 07 May 2024 06:17 PM